- 437 Madison Ave, New York, NY 10022 United States

Grid Bot

December 23, 2024 2025-01-13 12:55Grid Bot

Types of X-FLEXI Grid Bot Strategies

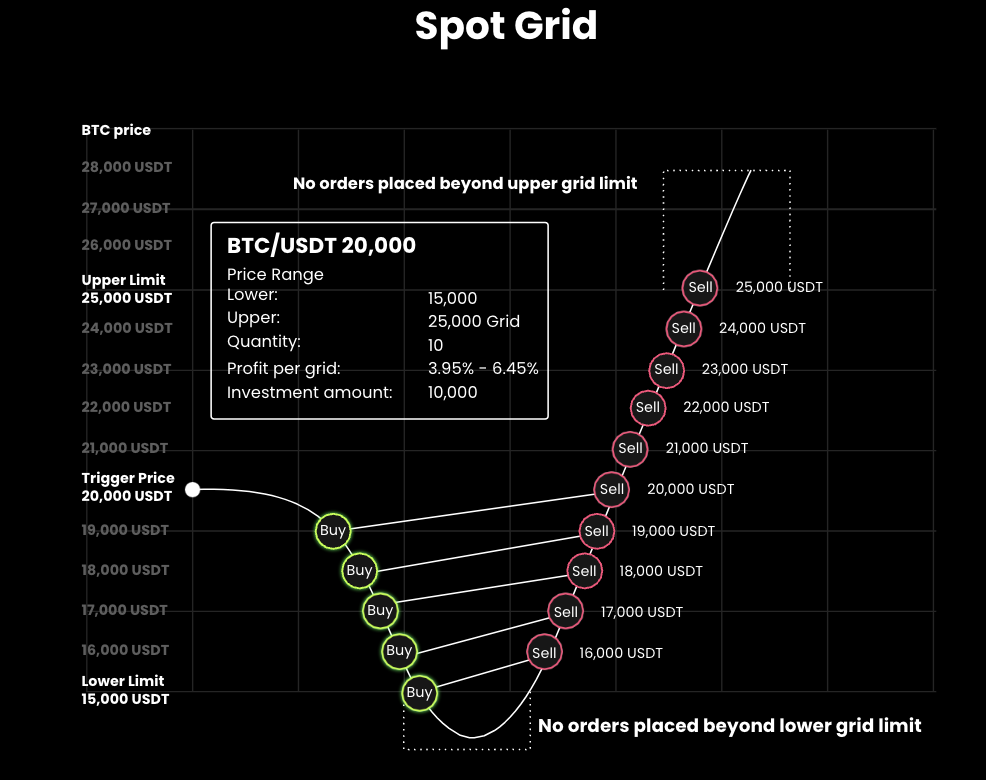

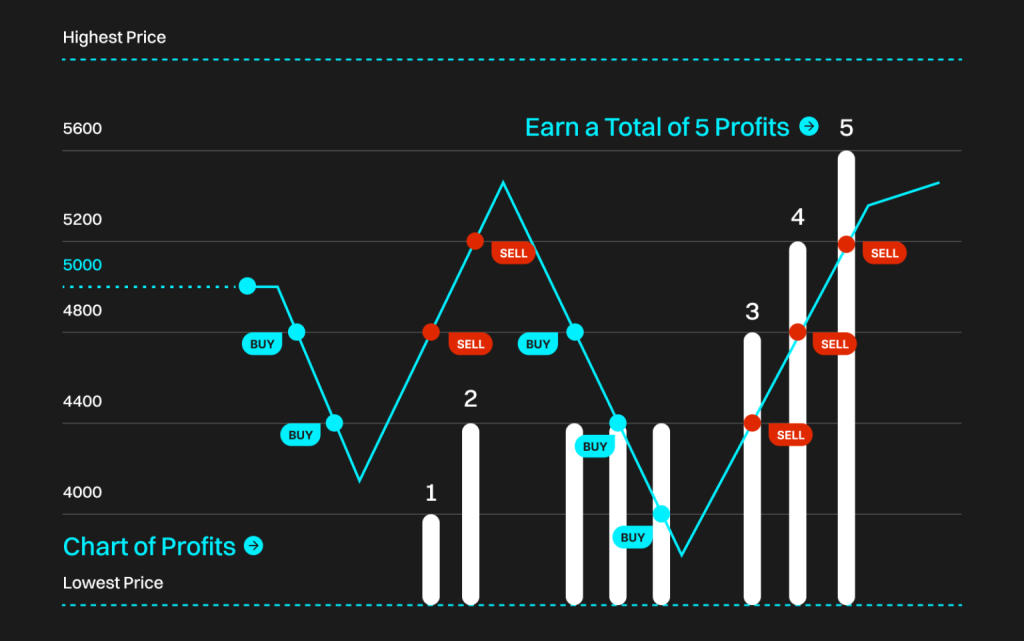

Spot Grid Strategies

It works by placing a series of buy and sell orders at specific price levels to profit from market fluctuations. This strategy operates in the spot market, executing real-time buy and sell transactions. Traders can capitalize on price changes by using this order grid.

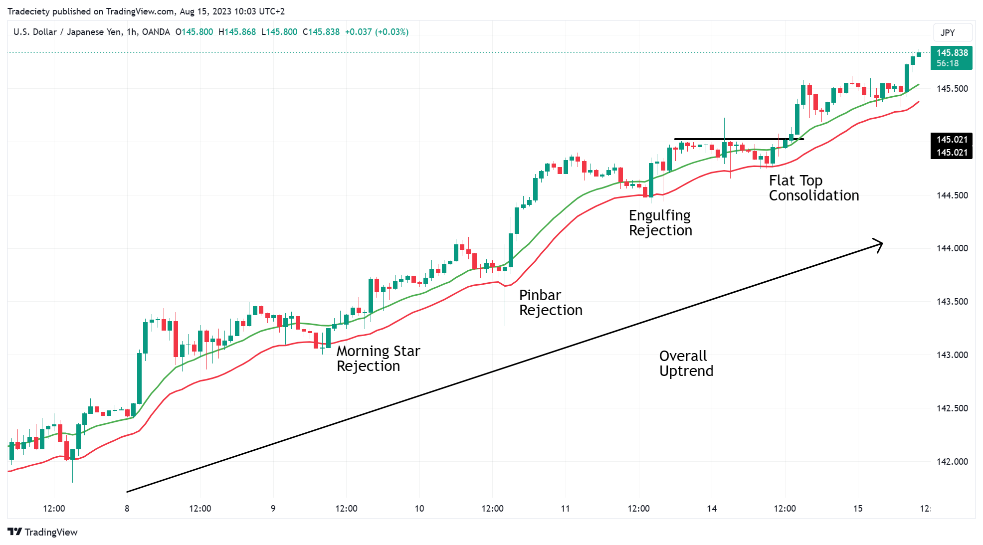

Trend Following Grid Strategy

The bot places buy orders below the market price and sell orders above it but adjusts the grid size and spacing based on market trends. For instance, the grid might widen during volatile trends and tighten during sideways market movements.

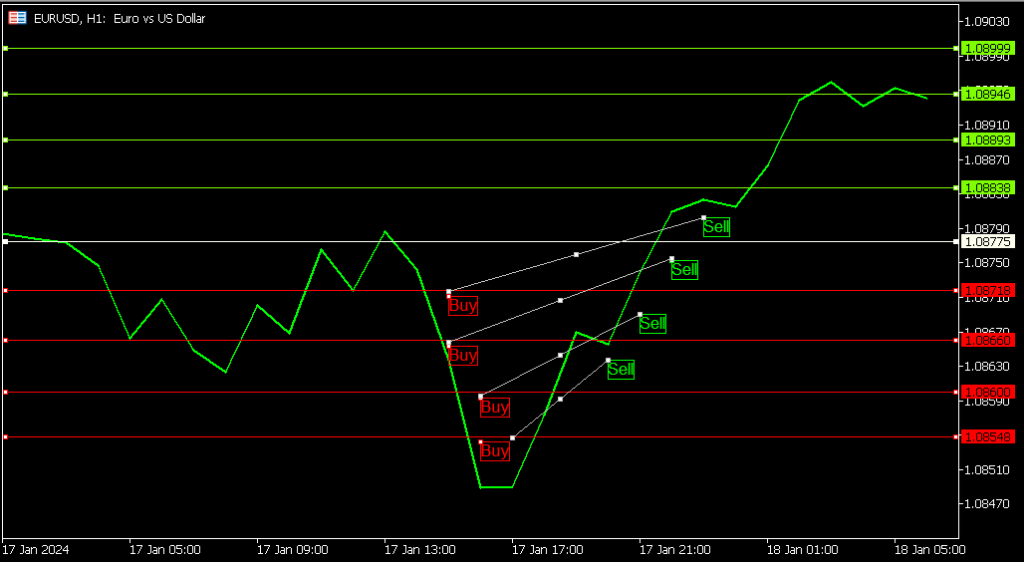

Reversal Grid Strategy

The bot places buy orders below the current market price when the market is in a downtrend and sell orders above when the market is in an uptrend, looking to capitalize on reversals.

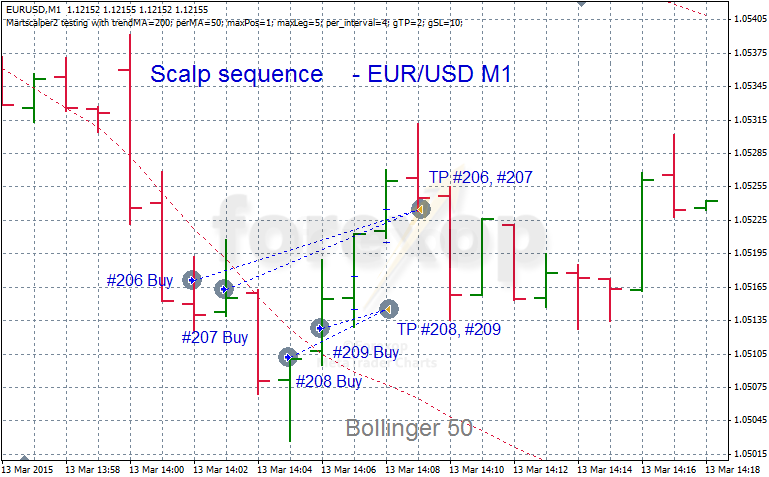

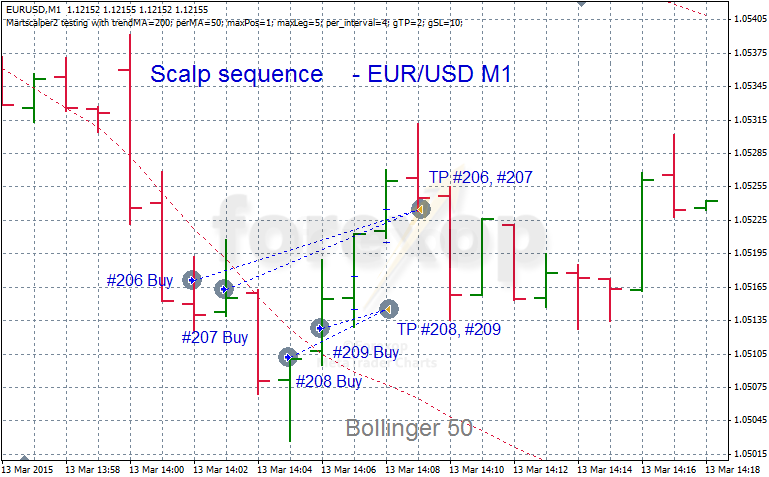

Scalping Grid Strategy

This strategy focuses on making small profits from frequent trades. The bot places buy and sell orders in very tight intervals, typically on a highly liquid asset, aiming to capitalize on small price fluctuations.

Futures Grid Strategy

The Futures Grid Bot creates a grid of buy and sell orders at predetermined prices, aiming to profit from price fluctuations in the futures market. By utilizing a grid strategy, it capitalizes on market fluctuations and trends to generate profits from price movements.

Dynamic Grid Strategy

This strategy adjusts the grid size based on market conditions. The bot monitors price volatility and adjusts the grid spacing accordingly to adapt to changes in the market environment.

Hedging Grid Strategy

The bot places buy and sell orders at predetermined grid levels above and below the current market price and uses a hedging mechanism to offset any losses or mitigate risk. Typically, this includes using stop-loss orders, options, or other strategies to protect positions from large market swings.

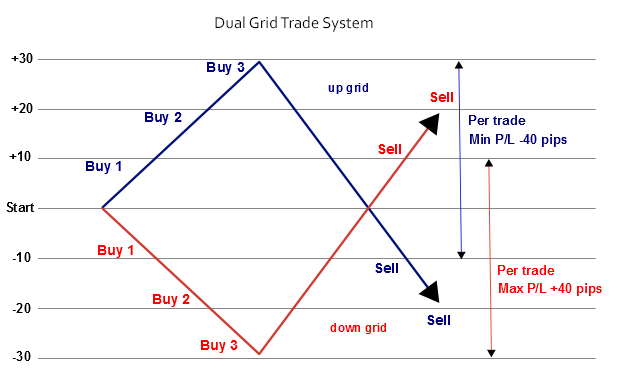

Two-Way Grid Strategy

The Two-Way Grid Bot covers both sides of the market by placing buy and sell orders, aiming to profit from price fluctuations within a specified grid interval.

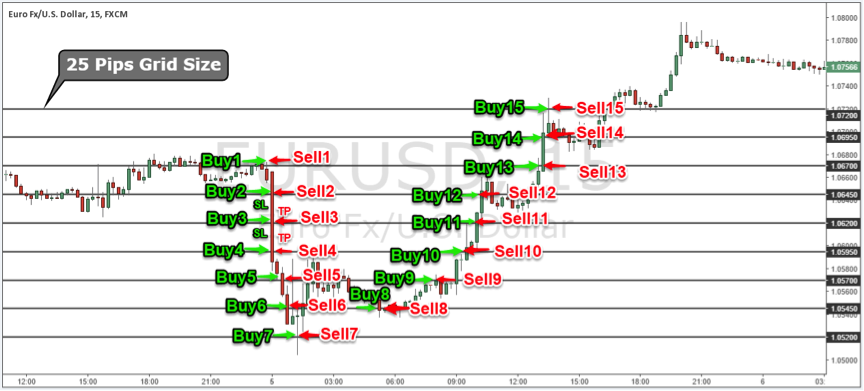

Interval Grid Strategy

This bot works by setting up a grid of buy and sell orders at predefined price intervals. These intervals represent the price levels at which the bot executes trades. The main goal of the Interval Grid Bot is to profit from price movements within a specified range.

Unlimited Grid Strategy

The bot places an infinite series of buy and sell orders above and below the market price, with no set upper or lower limits. As the market price moves, new orders are continuously added, adapting to fluctuations in real time.